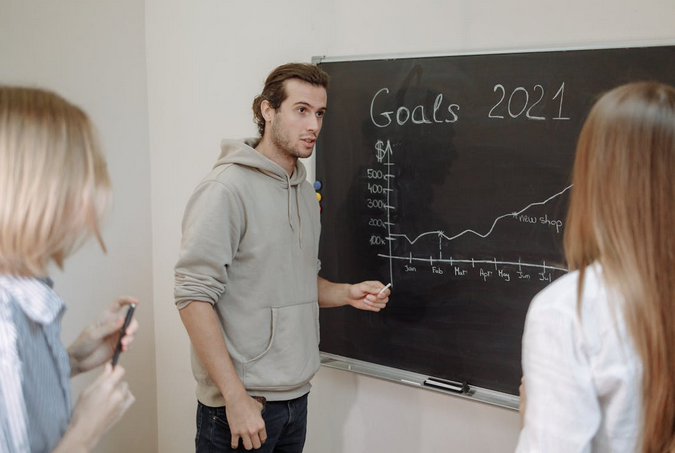

January has a way of making people ambitious. New planners appear. Budget apps get downloaded. Big promises float around like confetti that never quite gets swept up. It feels productive, hopeful, and slightly overwhelming all at once. Before you rush into bold money goals in 2026, pause for a moment and grab a cup of something warm. Financial goals work best when they come from clarity, not guilt. Many people set targets while still emotionally tired from December spending. That emotional fog can lead to plans that look good on paper but collapse by February. This article is here to slow things down just enough. A calmer start now saves frustration later.

Check Your Financial Pulse Before Setting Targets

Before setting goals, take an honest snapshot of where you stand. This includes balances, recent spending, and upcoming obligations. Avoid judging the numbers. They are information, not a verdict. Data becomes useful only after emotions step aside. Think of this step like checking the weather before leaving the house. You would not plan a picnic during a storm. Financial goals deserve the same logic. Knowing your current position helps you choose realistic moves. Reality makes plans stronger, not smaller.

Stop Copying Goals That Are Not Yours

Many New Year’s goals come from social pressure. Save more. Invest faster. Pay everything off immediately. These phrases sound impressive, but ignore personal context. What works for one person may feel suffocating to another. Your income, responsibilities, and stress tolerance matter. Goals should fit your life, not impress strangers. A smaller goal you actually follow beats a flashy one you abandon. Money progress is private, not performative.

Build Systems Instead of Relying on Motivation

Motivation is unreliable. It fades after long workdays or stressful weeks. Systems keep working even when energy drops. Automatic transfers, calendar reminders, and fixed routines reduce decision fatigue. A system removes drama from money choices. You do not debate saving if it happens automatically. Quiet systems do heavy lifting in the background.

Set Fewer Goals and Make Them Boring

Ambition often shows up as a long list. Save this much. Cut that expense. Start investing. Build an emergency fund. Too many goals compete for attention and energy. That split focus usually leads to burnout. Simply pick one or two priorities. Make them simple. Boring goals tend to survive busy weeks and bad moods.

Leave Space for Flexibility and Life

Rigid goals break easily. Life interrupts plans without asking permission. Unexpected expenses, schedule changes, or emotional days happen to everyone. A good financial plan expects disruption. Build margins into your goals. Allow room to adjust without quitting. Progress does not require flawless execution. It requires resilience.

Setting New Year financial goals should feel grounding, not stressful. A slower start creates steadier results. When goals match reality, they stop feeling like chores. They become habits that quietly support your life. Take this moment to reset expectations. Choose clarity over pressure. Your future self will appreciate the patience you showed today.…

High-net-worth individuals (HNWIs) have distinct characteristics that set them apart. They often possess investable assets exceeding one million dollars, but their needs and preferences go beyond mere numbers. This group typically values personalized service and trusts firms that understand their financial goals. They seek tailored investment strategies rather than cookie-cutter solutions.

High-net-worth individuals (HNWIs) have distinct characteristics that set them apart. They often possess investable assets exceeding one million dollars, but their needs and preferences go beyond mere numbers. This group typically values personalized service and trusts firms that understand their financial goals. They seek tailored investment strategies rather than cookie-cutter solutions. Branding plays a crucial role in attracting high-net-worth clients. It creates an image of trust and reliability, essential for individuals managing significant assets. A well-defined brand communicates expertise and professionalism. High-net-worth individuals are discerning consumers. They seek personalized services that reflect their unique needs and aspirations.

Branding plays a crucial role in attracting high-net-worth clients. It creates an image of trust and reliability, essential for individuals managing significant assets. A well-defined brand communicates expertise and professionalism. High-net-worth individuals are discerning consumers. They seek personalized services that reflect their unique needs and aspirations.

One of the advantages of investing in precious metals is that they are considered a safe haven asset. When markets become volatile, investors can turn to these investments for stability and security. In addition, precious metals have an intrinsic value due to their rarity and demand, making them attractive investments even during economic downturns.

One of the advantages of investing in precious metals is that they are considered a safe haven asset. When markets become volatile, investors can turn to these investments for stability and security. In addition, precious metals have an intrinsic value due to their rarity and demand, making them attractive investments even during economic downturns.

One of the most common reasons people take out personal loans is to consolidate their credit card debt. Credit cards often come with high-interest rates and can make it challenging to pay off your monthly balance. With a personal loan, you can combine all your credit card debts into one loan with a lower interest rate, making it easier to manage your payments. This can help you save money in the long run by reducing the interest you pay on debts.

One of the most common reasons people take out personal loans is to consolidate their credit card debt. Credit cards often come with high-interest rates and can make it challenging to pay off your monthly balance. With a personal loan, you can combine all your credit card debts into one loan with a lower interest rate, making it easier to manage your payments. This can help you save money in the long run by reducing the interest you pay on debts. Finally, personal loans can also help cover unexpected expenses. For example, taking out a personal loan can provide the necessary funds to help cover an emergency expense such as an unexpected medical bill or car repair. This can save you money in the long run by allowing you to avoid high-interest credit card debt or having to dip into your emergency savings account.

Finally, personal loans can also help cover unexpected expenses. For example, taking out a personal loan can provide the necessary funds to help cover an emergency expense such as an unexpected medical bill or car repair. This can save you money in the long run by allowing you to avoid high-interest credit card debt or having to dip into your emergency savings account.

One of the top considerations that should always matter is security. It is advised that you take a look at the safety record of a site before buying Bitcoins from it. How many times have it been hacked? What are the measures that took place to prevent such crimes?

One of the top considerations that should always matter is security. It is advised that you take a look at the safety record of a site before buying Bitcoins from it. How many times have it been hacked? What are the measures that took place to prevent such crimes? Once into Bitcoins, you are entering a select community. This cryptocurrency is where you buy or sell Bitcoins. If you want to mix with other Bitcoin users, you can do so through online or even personal meet up. If a Bitcoin site operates in more countries, it means that you belong to a larger cryptocurrency community.

Once into Bitcoins, you are entering a select community. This cryptocurrency is where you buy or sell Bitcoins. If you want to mix with other Bitcoin users, you can do so through online or even personal meet up. If a Bitcoin site operates in more countries, it means that you belong to a larger cryptocurrency community.

Do not forget about fees when setting up a gold IRA account. Opening a gold IRA account is likely to be more expensive than a normal investment account. There are many fees involved, so you need to be aware of that when opening a gold IRA account.

Do not forget about fees when setting up a gold IRA account. Opening a gold IRA account is likely to be more expensive than a normal investment account. There are many fees involved, so you need to be aware of that when opening a gold IRA account. Many people usually shy away from enlisting the services of a financial planner for fees charged for these services. The reason does make some sense, but only to some extent. There are many reasons why you should hire a financial planner. The only catch is you have to choose one with experience and an excellent reputation to ensure you get the best services. Below are some top reasons to hire an experienced financial planner.

Many people usually shy away from enlisting the services of a financial planner for fees charged for these services. The reason does make some sense, but only to some extent. There are many reasons why you should hire a financial planner. The only catch is you have to choose one with experience and an excellent reputation to ensure you get the best services. Below are some top reasons to hire an experienced financial planner. With the right financial advisor, it will be easier for you to reach various financial goals that you might have set. If you want to save money to buy a new house, a new car, or for an upcoming wedding, the financial advisor will show you how to set aside some money that will be used for such purposes. He can also help you to increase your overall income, allowing you to hit your goals much sooner.

With the right financial advisor, it will be easier for you to reach various financial goals that you might have set. If you want to save money to buy a new house, a new car, or for an upcoming wedding, the financial advisor will show you how to set aside some money that will be used for such purposes. He can also help you to increase your overall income, allowing you to hit your goals much sooner.

To sustain cash flow for your business, one great option that you can have is the so-called merchant cash advance. This is applicable if you are accepting credit cards.

To sustain cash flow for your business, one great option that you can have is the so-called merchant cash advance. This is applicable if you are accepting credit cards.

As you probably know, these are short-term loans with repayment duration of between 1 and 12 months. Also, they are secured against the second or first charge basis. The fact that they are secured against property means that they are non-status with no proof of income or credit checks required. It is possible to get a loan that is 100% of the property value. However, in most cases, you will be financed with 70% of the property value. The property can be an investment, land, commercial, or residential.

As you probably know, these are short-term loans with repayment duration of between 1 and 12 months. Also, they are secured against the second or first charge basis. The fact that they are secured against property means that they are non-status with no proof of income or credit checks required. It is possible to get a loan that is 100% of the property value. However, in most cases, you will be financed with 70% of the property value. The property can be an investment, land, commercial, or residential.

For a person thinking about the best source of income, trading may seem like a great way to earn a six figure profit yearly. There are a lot of advertisements that may lure a person to consider trading, forgetting that trading greatly depends on the market behavior. The truth is that trading can be daunting, especially for a person considering day trading as a means to earn a living.

For a person thinking about the best source of income, trading may seem like a great way to earn a six figure profit yearly. There are a lot of advertisements that may lure a person to consider trading, forgetting that trading greatly depends on the market behavior. The truth is that trading can be daunting, especially for a person considering day trading as a means to earn a living.

Buying high-quality stocks and holding them for some time is a good strategy when it comes to investing in trading. This is a good way to make sure that you make money in both the bulls and the bears market while maximizing the profits and minimizing the losses. Therefore, trading can be a good source of income, but only through the use of strategic tools and most importantly, if you know how to avoid scams. You can click here and learn more.…

Buying high-quality stocks and holding them for some time is a good strategy when it comes to investing in trading. This is a good way to make sure that you make money in both the bulls and the bears market while maximizing the profits and minimizing the losses. Therefore, trading can be a good source of income, but only through the use of strategic tools and most importantly, if you know how to avoid scams. You can click here and learn more.…

Hiring experienced management consultants has a lot of benefits. For instance, since they have been doing this job for long, they understand the major accounting challenges that organizations go through and so, they will be better positioned to solve them. They also are aware of the ever-changing needs of

Hiring experienced management consultants has a lot of benefits. For instance, since they have been doing this job for long, they understand the major accounting challenges that organizations go through and so, they will be better positioned to solve them. They also are aware of the ever-changing needs of

es. Using this criterion, you should be able to gauge which company offers the best quality work at the most affordable price. You might be tempted to go to the lowest bidder, but it is reasonable not to compromise on quality. If there is a company that will be using higher quality material and better expertise for a slightly higher price, then it is a worthy sacrifice.

es. Using this criterion, you should be able to gauge which company offers the best quality work at the most affordable price. You might be tempted to go to the lowest bidder, but it is reasonable not to compromise on quality. If there is a company that will be using higher quality material and better expertise for a slightly higher price, then it is a worthy sacrifice.

Unlike when using other methods to raise funds for your business, marketing an Initial Coin Offering is quite easy. Since everything is done online, the sky is the limit when it comes to this. You simply need to set your systems in place, and leverage on online tools to get to your desired targets. This can be done by use of free tools. For instance, you can easily integrate the ICO with social media so that people can share it. The more it is shared, the more you are likely to reach more people without even having to struggle too much through the marketing process.

Unlike when using other methods to raise funds for your business, marketing an Initial Coin Offering is quite easy. Since everything is done online, the sky is the limit when it comes to this. You simply need to set your systems in place, and leverage on online tools to get to your desired targets. This can be done by use of free tools. For instance, you can easily integrate the ICO with social media so that people can share it. The more it is shared, the more you are likely to reach more people without even having to struggle too much through the marketing process. respect to all the properties that is damaged in case of an accident.

respect to all the properties that is damaged in case of an accident. business purposes will require you to pay more that private cars. Your mileage also determines the amount of premium that your pay.

business purposes will require you to pay more that private cars. Your mileage also determines the amount of premium that your pay. Consumer loans are debts that are provided to individuals who are seeking for financial assistance. A certain amount of money is lent to a borrower with an interest rate that needs to be paid on top of the principal amount. In addition to this, terms of payment are also provided. There are many types of consumer loans that you can avail of depending on the intended purpose. If you are aiming to buy a house, you may apply for a house loan. The same way if you want to get a car, you can take advantage of a car or auto loan. There are also business loans, salary loans, personal loans, and many more.

Consumer loans are debts that are provided to individuals who are seeking for financial assistance. A certain amount of money is lent to a borrower with an interest rate that needs to be paid on top of the principal amount. In addition to this, terms of payment are also provided. There are many types of consumer loans that you can avail of depending on the intended purpose. If you are aiming to buy a house, you may apply for a house loan. The same way if you want to get a car, you can take advantage of a car or auto loan. There are also business loans, salary loans, personal loans, and many more. Loan applications can already be filed online. You just have to be patient in searching in order for you to get the best deal. If you visit the website www.cibank.dk, you will be able to compare some lending companies. You will have an idea of the different rates, loanable amount, as well as how long it would take them to process and approve your application.…

Loan applications can already be filed online. You just have to be patient in searching in order for you to get the best deal. If you visit the website www.cibank.dk, you will be able to compare some lending companies. You will have an idea of the different rates, loanable amount, as well as how long it would take them to process and approve your application.… When it comes to taxes, everything has to be properly planned. This starts by going through your financial information to understand how much tax you are supposed to pay. You also need to know the various types of tax that apply to your business, and the laws that dictate how they should be paid. This can be overwhelming work for someone who does not have proper knowledge about tax issues, and therefore, the best thing you can do is to search for an agent that knows how to do it best.

When it comes to taxes, everything has to be properly planned. This starts by going through your financial information to understand how much tax you are supposed to pay. You also need to know the various types of tax that apply to your business, and the laws that dictate how they should be paid. This can be overwhelming work for someone who does not have proper knowledge about tax issues, and therefore, the best thing you can do is to search for an agent that knows how to do it best. It is important to have a professional who will go through your financial statements including taxes that you have been paying to know if you have been taxed rightly. Some people end up paying more tax than they should, and they deserve a refund. You would never know about this if you do not even know to analyze your finances. Even when you know that you deserve a return, you will not know how to appeal. This requires a professional who knows how to present the case so that you get what is fair for you.

It is important to have a professional who will go through your financial statements including taxes that you have been paying to know if you have been taxed rightly. Some people end up paying more tax than they should, and they deserve a refund. You would never know about this if you do not even know to analyze your finances. Even when you know that you deserve a return, you will not know how to appeal. This requires a professional who knows how to present the case so that you get what is fair for you. To make it easier for everyone to overcome financial crisis, Car Title Loan, also known as auto loan, came into the picture. With this, there is no need to worry about credit history. As long as you have a car, you will have the chance to enjoy the benefits of this type of loan. The good thing about this debt is you will still be able to use your car anytime you want. It would still be in your possession. You will just have to surrender the title of your automobile to the lending company until the time you get to pay the loan off.

To make it easier for everyone to overcome financial crisis, Car Title Loan, also known as auto loan, came into the picture. With this, there is no need to worry about credit history. As long as you have a car, you will have the chance to enjoy the benefits of this type of loan. The good thing about this debt is you will still be able to use your car anytime you want. It would still be in your possession. You will just have to surrender the title of your automobile to the lending company until the time you get to pay the loan off. Fast Title Loan HQ is the best place for you to go if you are thinking about getting a car title loan. One advantage is that you can submit your application online, or you can just call them. You will be provided with an appraisal in minutes and you can avail of up to $50,000 depending on the automobile that you have. You no longer have to worry about credit history nor employment check.…

Fast Title Loan HQ is the best place for you to go if you are thinking about getting a car title loan. One advantage is that you can submit your application online, or you can just call them. You will be provided with an appraisal in minutes and you can avail of up to $50,000 depending on the automobile that you have. You no longer have to worry about credit history nor employment check.…

Car insurance comes in different packages. You may get one depending on your budget. Most of the time, insurers will ask for a down payment, but there are also insurance companies that offer affordable car insurance with no down payment. This is beneficial to those car owners who have a limited budget because they won’t have to make an initial payment to avail of a package. What would happen is that the total cost of the insurance package would be divided according to the contract and monthly payments will be made.

Car insurance comes in different packages. You may get one depending on your budget. Most of the time, insurers will ask for a down payment, but there are also insurance companies that offer affordable car insurance with no down payment. This is beneficial to those car owners who have a limited budget because they won’t have to make an initial payment to avail of a package. What would happen is that the total cost of the insurance package would be divided according to the contract and monthly payments will be made. There are different types of car insurance packages that a car owner could choose from. The cost would, of course, vary depending on the coverage of the insurance that you would like to purchase. Getting a car insurance with no down payment sounds friendly because you won’t have to worry about the overwhelming lump sum amount that you would need if you opt to pay it upfront. Plus, the monthly installments would be small. This is a great help particularly for those who are working and relying on their monthly paychecks.

There are different types of car insurance packages that a car owner could choose from. The cost would, of course, vary depending on the coverage of the insurance that you would like to purchase. Getting a car insurance with no down payment sounds friendly because you won’t have to worry about the overwhelming lump sum amount that you would need if you opt to pay it upfront. Plus, the monthly installments would be small. This is a great help particularly for those who are working and relying on their monthly paychecks. Income Tax Refund is the term that is being used when you get a reimbursement from the money that was deducted from your paychecks within a particular year for tax payment purposes. The government agency that is in charge of taxes will determine the amount due through a certain formula. They will also consider tax exemptions that you are rightfully qualified to. One of these exemptions is the number of children or dependents that you have. Another possible exemptions are the expenses that are related to your work. In order for you to identify the possible claims that you may file, you need the help of an accounting firm like Optima Partners. They will be able to assist you better in filing and minimizing your taxes.

Income Tax Refund is the term that is being used when you get a reimbursement from the money that was deducted from your paychecks within a particular year for tax payment purposes. The government agency that is in charge of taxes will determine the amount due through a certain formula. They will also consider tax exemptions that you are rightfully qualified to. One of these exemptions is the number of children or dependents that you have. Another possible exemptions are the expenses that are related to your work. In order for you to identify the possible claims that you may file, you need the help of an accounting firm like Optima Partners. They will be able to assist you better in filing and minimizing your taxes. It is highly recommended that you seek the help of an accountant or a taxation professional to guide you in filing your taxes. This way you will be able to review your documents thoroughly. You can identify all possible claims that you can avail of too in order to minimize your tax and improve the refund that you will be getting.…

It is highly recommended that you seek the help of an accountant or a taxation professional to guide you in filing your taxes. This way you will be able to review your documents thoroughly. You can identify all possible claims that you can avail of too in order to minimize your tax and improve the refund that you will be getting.… clarification by asking questions. You should not bring personal bias into meetings. You should note that the customer has his or her belief system. Therefore, you are bound to respect customers for whom they are.

clarification by asking questions. You should not bring personal bias into meetings. You should note that the customer has his or her belief system. Therefore, you are bound to respect customers for whom they are. too much. Remember that you are meeting people from different backgrounds and have different values.

too much. Remember that you are meeting people from different backgrounds and have different values. make your financial future secure.

make your financial future secure. Utilizing employee benefits

Utilizing employee benefits future. That is why you have no choice but to make sure that you get the debt off your back. Fortunately, there are many things that you can do to get rid of your student’s loan burden. You can get some help from the student loan forgiveness website guide. If you are thinking about making repayment, but you want shave thousands off your student’s loan, here are the things that you can do;

future. That is why you have no choice but to make sure that you get the debt off your back. Fortunately, there are many things that you can do to get rid of your student’s loan burden. You can get some help from the student loan forgiveness website guide. If you are thinking about making repayment, but you want shave thousands off your student’s loan, here are the things that you can do; A fine is usually charged to people who do not make the required payments every month. If you want to avoid these fines, you should pay the minimum amount of money that you are required to pay every month. However, keep in mind the fact that that it will take you longer to complete the repayment of your loan if you make slow payments. Students loans attract a small interest rate every year. You will save thousands if you make an effort to complete repaying your loan within a short period.

A fine is usually charged to people who do not make the required payments every month. If you want to avoid these fines, you should pay the minimum amount of money that you are required to pay every month. However, keep in mind the fact that that it will take you longer to complete the repayment of your loan if you make slow payments. Students loans attract a small interest rate every year. You will save thousands if you make an effort to complete repaying your loan within a short period. situation where cash is required urgently. Likewise, you might have to pay your mortgage immediately or risk losing your savings due to a default in repayment. In such cases, a licensed money lender in Singapore can be beneficial.

situation where cash is required urgently. Likewise, you might have to pay your mortgage immediately or risk losing your savings due to a default in repayment. In such cases, a licensed money lender in Singapore can be beneficial. Get a loan for financial problems that banks would not consider

Get a loan for financial problems that banks would not consider every month. However, before you apply, you need to know the following three things:

every month. However, before you apply, you need to know the following three things: remain with you. In fact, you can pay the loan back without selling the property. If the value of the home is higher than the value of the loan, beneficiaries can settle the debt and take the home back. In essence, it is impossible for the loan amount to exceed the home value as your home is used as collateral.

remain with you. In fact, you can pay the loan back without selling the property. If the value of the home is higher than the value of the loan, beneficiaries can settle the debt and take the home back. In essence, it is impossible for the loan amount to exceed the home value as your home is used as collateral. tor’s home country. Before you stash your hard-earned cash, you need to know its advantages and disadvantages. You will note that there is a large money market, equity assets, bonds, and stocks provided by reputable offshore companies. All these are time-tested, fiscally sound, and legal.

tor’s home country. Before you stash your hard-earned cash, you need to know its advantages and disadvantages. You will note that there is a large money market, equity assets, bonds, and stocks provided by reputable offshore companies. All these are time-tested, fiscally sound, and legal. entiality. If confidentiality is breached, then there are consequences for the offending party. Divulging customer identities is an example of breaching confidentiality in most

entiality. If confidentiality is breached, then there are consequences for the offending party. Divulging customer identities is an example of breaching confidentiality in most

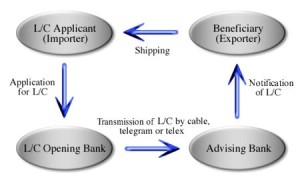

The mutually agreed terms and conditions between the buyer and the seller before the actual commencement of a transaction can help in determining the duration credit period under the letter of credit. In fact the total period of credit, as per government regulations, should not be more than 180 days but a foreign buyer can opt for 30, 60, 90 or 120 days as period of credit in certain transactions.

The mutually agreed terms and conditions between the buyer and the seller before the actual commencement of a transaction can help in determining the duration credit period under the letter of credit. In fact the total period of credit, as per government regulations, should not be more than 180 days but a foreign buyer can opt for 30, 60, 90 or 120 days as period of credit in certain transactions.

5. Higher returns

5. Higher returns